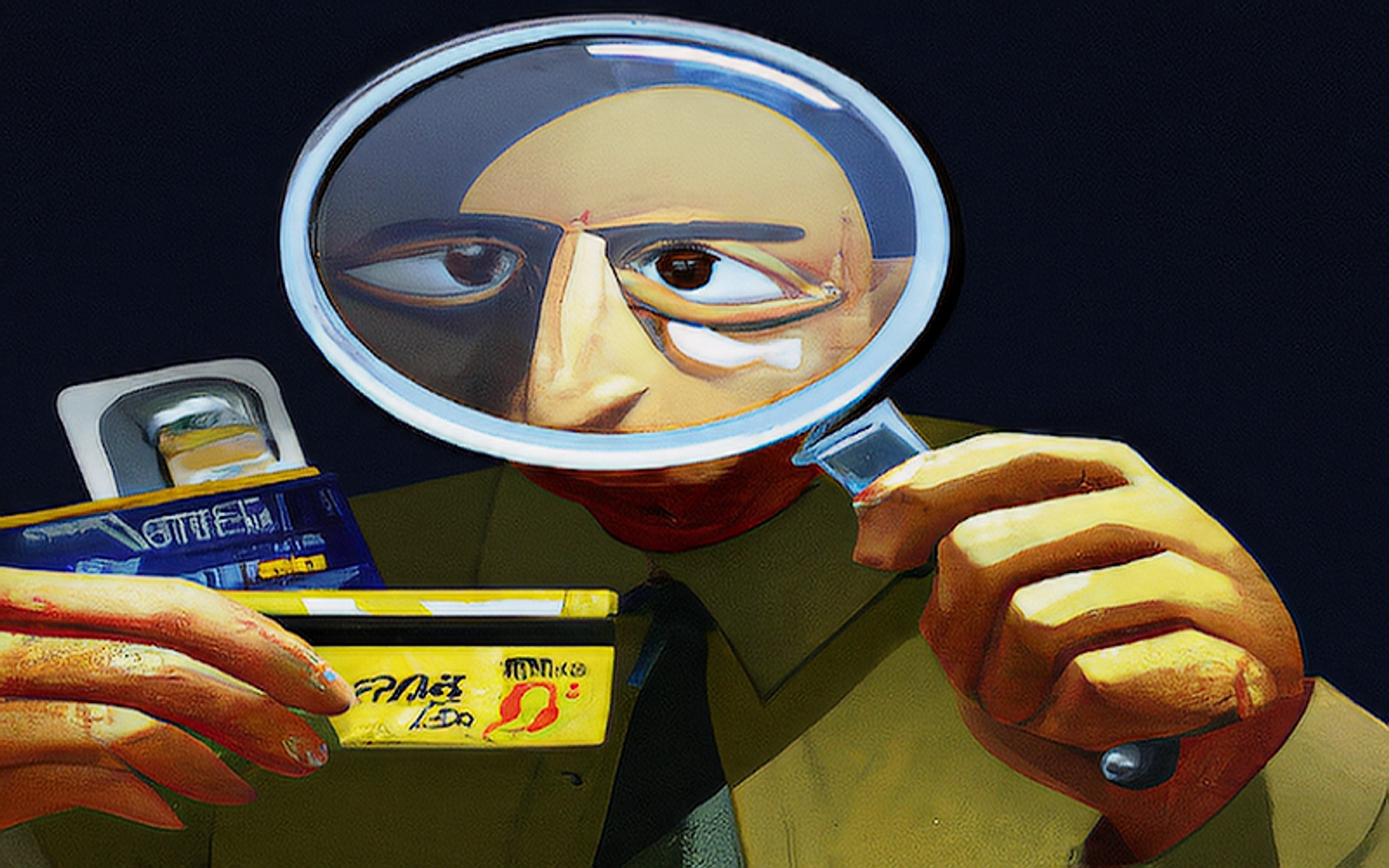

What do the numbers of your credit card mean?

azzy

Credit cards are more than just plastic money; they are a blend of security features, identification, and financial information. Understanding the meaning behind the numbers on your credit card is not just a trivia fact; it’s a step towards better financial literacy and security.

A Deep Dive into the Numbers

1. The First Digit: Industry Identifier

The very first digit of your credit card number is known as the Major Industry Identifier (MII). It indicates the card's issuing industry. For example, a number starting with '4' signifies it's a Visa card, while '5' indicates a MasterCard. This number is crucial in identifying the type of card and the industry it belongs to.

2. The First Six Digits: Issuer Identification Number (IIN)

The first six digits on your card, which include the MII, form the Issuer Identification Number (IIN), previously known as the Bank Identification Number (BIN). This set of numbers identifies the institution that issued your card. For instance, different banks have different IINs, even if they issue the same type of card, like Visa or MasterCard.

3. The Account Number: Your Unique Identifier

Following the IIN, the next set of numbers (up to 12 digits) is your unique account number. No two cards have the same account number. This sequence is what sets your credit card apart from millions of others. It's linked directly to your personal credit card account at the issuing bank.

4. The Check Digit: A Safety Check

The last digit of your credit card number is known as the check digit. It's used to validate the card number using the Luhn Algorithm – a mathematical formula used to verify the correctness of identification numbers. This digit helps prevent errors like incorrect card number entries.

Enhanced Security Features

1. The CVV: An Extra Layer of Security

The Card Verification Value (CVV), also known as the security code, is not part of the credit card number but is essential for transaction security. This 3 or 4-digit number is used in online transactions to verify that you have physical possession of the card.

2. Expiration Date: Time-Limited Validity

The expiration date on your card signifies the end of its usage period. This is crucial for security purposes and helps issuers manage their card portfolios effectively.

3. EMV Chips: Advanced Security Technology

Many modern credit cards come with an EMV chip – named after its developers, Europay, MasterCard, and Visa. These chips store your data securely and make counterfeiting significantly harder.

The Significance of These Numbers in the Digital Age

In an era where digital transactions are dominant, understanding your credit card numbers becomes crucial. They’re not just identifiers but also gateways to your financial health. With the rise of online fraud, knowing these details helps in recognizing suspicious activities.

Responsible Credit Card Usage Tips

1. Regularly Monitor Your Statements

Keep a close eye on your credit card statements. Report any unauthorized transactions immediately to your bank.

2. Keep Your Card Details Confidential

Never share your credit card number, CVV, or expiration date with untrusted sources.

3. Be Aware of Phishing Scams

Be vigilant about phishing attempts that ask for your credit card details via email or phone.

Your credit card is a marvel of financial technology, with every number serving a purpose. From the industry identifier to the check digit, each aspect of your credit card number plays a crucial role in your financial journey. Understanding these numbers is the first step toward smart and secure financial management.